Money Advice

All Your Worth : The Ultimate Lifetime Money Plan

All Your Worth : The Ultimate Lifetime Money Plan

The reason I don’t watch Dr. Phil is that I keep expecting to hear stuff like that whenever I catch a few minutes of it, but a couple of days ago my wife said I should sit and watch with her because the show would be on common financial mistakes couples make in other words it help for lifetime money plan. So sure, I’ll give it a whirl.

The show was mainly a plug for a new book called All Your Worth : The Ultimate Lifetime Money Plan by Elizabeth Warren, but it did have some good advice.

The show was mainly a plug for a new book called All Your Worth : The Ultimate Lifetime Money Plan by Elizabeth Warren, but it did have some good advice.

The first thing I noted was a Phil-ism:

‘You can’t fix money problems with money’

and that is true in a way. Most people do not have the resources to just throw money at money problems, because most people are too busy throwing money down the drain anyway. So when you can’t increase revenue, you need to decrease spending.

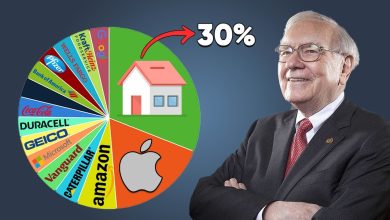

Elizabeth Warren’s advice in most segments boiled down to a simple formula for lifetime money plan and she is breaking up spending based on wants and needs:

So, you aim to spend roughly 50% of your income on the things you must have, 30% on the things you want to have, and save 20%. Judging by the guests on the show, that is easier done than said. Most of the guests were spending 80% of their income on needs, and 60% on wants with 0% spending. Of course the math leaves a lot to be desired, but some of these people were spending 140% of their income or more every month thanks to credit cards and equity loans.

What is the 50 30 20 budget?

Your needs, which should be limited to just 50 percent of your net income. Your wants, which should only take up 30 percent of your budget and spending. Your savings and debt repayments, which should equal at least 20 percent of the money you earn each month.

There is then various advice to help you fit the 50/30/20 model:

- Dual income families need to move to single income spending when the wife has kids and chooses to be a stay at home mom.

Sounds easy, doesn’t it? My wife and I did not have as much trouble with this because we were not dual full-time income. When Kim worked, I was in school, and I never had more than a part-time job. Now that she raises the kids and I work, my job pays more than what we made together when I was in school. That being said, some do not have it so easy, and it is hard to cut back to a single income lifestyle when you’ve been living it up on dual salaries. - Spend cash if you are a compulsive spender or have trouble balancing the books.

The theory here is that if all your spending is done by taking cash from your wallet, you will be more aware of how much cash is left and what percentage of it you are about to drop on that new jacket. I personally seem to see cash as something that burns a hole in my wallet, so I am not sure this step would work for me personally, but YMMV. - Base your spending on what you can afford, not what you want. Be realistic.

Now this is good advice, it seems a little obvious, but is so new to most people. Heck, how many times have I looked at a Mac Mini longingly before realizing that A) I would hardly use it, and B) I can’t afford to spend that kind of money on a very stylish paperweight. - Don’t try to keep up with the Joneses, don’t use home equity as a line of credit.

One of the couples was using a home equity loan to try and maintain the same luxuries as the families on their block, buying multiple cars, a condo in Hawaii, and renovations they could not afford. The loan companies make the equity loan appealing, talking of how the loan is not a problem since it employs net worth you already have, and is paid in full when you pay the house, but the thing they don’t mention is that if you default on the equity loan you can lose the while house since the loan company does not just take and sell one bedroom.

Oh and finally, I would adjust the 50/30/20 model in one way:

I would call the 20% Savings/Debt Repayment. In my opinion making significant savings / lifetime money plan and investments before paying off debts is counter-productive: you will never get as large a return on your investments as you will be losing to interest on your debts, so pay them off first. Of course, you want to have an emergency fund (which we’ll talk about later), but if you have 20K in debt why try to amass 10K in savings? Pay off the debt first, then your money will be working for you, not against you.