Money AdviceStock Market

Should you buy the same stocks as Warren Buffett Portfolio?

Warren Buffett is best known as the CEO of Berkshire Hathaway and the most successful entrepreneur in history. What few know is that he has approved very simple information that any trader can use.

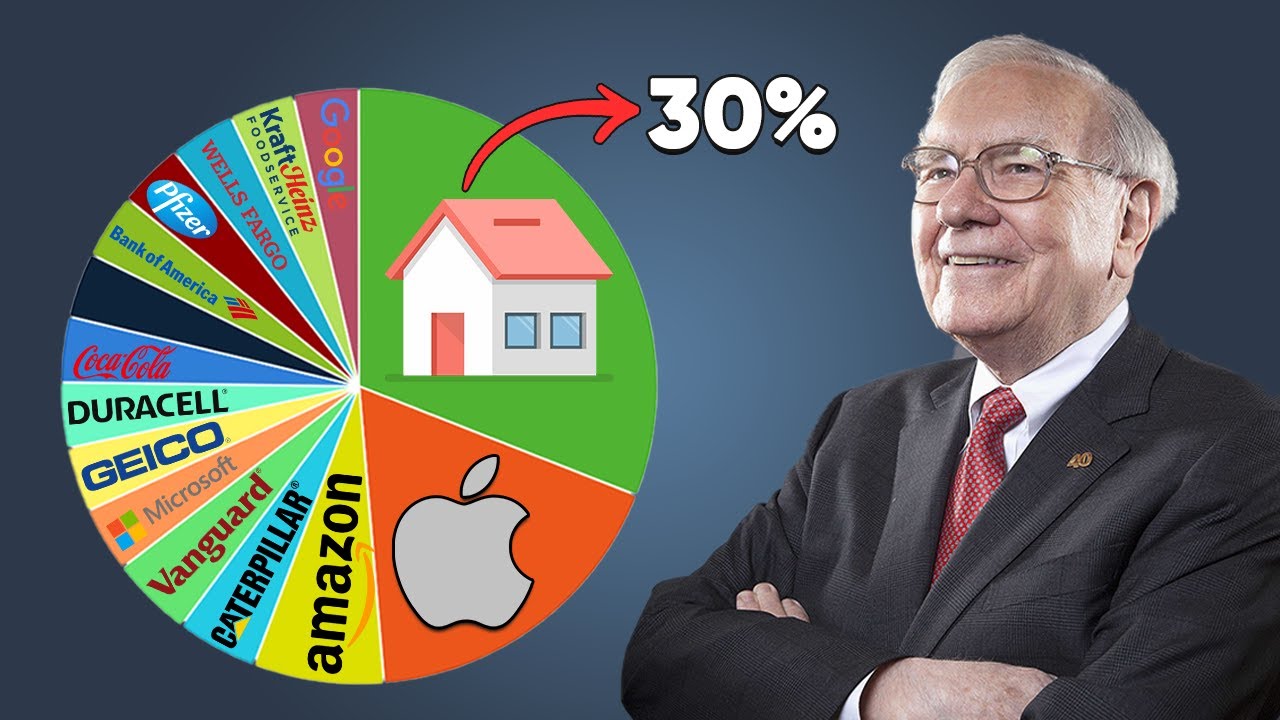

Not sure which stock to buy? Why not take a quote from Warren Buffett’s investment history and simply copy his record? Since last June, it includes Wells Fargo & Co., Coca-Cola Co., Wal-Mart Stores Inc., and American Express Co. in the top ten billionaire stocks. And invest in Procter & Gamble Co.

His records are currently worth up to $107,182,425,000(USD) still available online so you can see his entire final investment portfolio.

Buffett isn’t the only one making his portfolio visible to the world. Websites like Stockcircle track stock selection and information exchanges from some of the world’s top entrepreneurs and provide in-depth insights from Michael Burry or Cathie Wood and twelve others.

Warren Buffett’s portfolio has only two investments. The first is the investment portfolio that tracks the S&P 500. Buffett recommends investing 90% in the S&P 500 index fund. He specifically identified the S&P 500 index fund from Vanguard. Vanguard offers both an interactive version (VFIAX) and an ETF version (VOO) of these funds.

The publication of Buffett’s portfolio seems to be working very well. According to a 2008 article “Imitation is a Fact of Flattery: Warren Buffett and Berkshire Hathaway” by Gerald Martin of American University’s Kogod School of Business and John Puthenpurackal of the University of Nevada in 2008, if you practice Buffett’s Stock, 1976 Considering its 2006 to 2006 data (which changed a month after his company Berkshire Hathaway announced the move), it could outperform the S&P 500 by an average of 10.75% content per year.

It’s amazing. But while copying their investments seems straightforward enough, there are some real caveats.

An important question is whether Buffett’s portfolio is suitable for retirees. In all my research, I have not yet seen an investment advisor recommend a 90/10 portfolio once you retire. And for me, such a portfolio is just too aggressive.

When it comes to building a portfolio first, you must first know your own financial goals, time horizon and risk tolerance. When you copy one’s portfolio, make sure you practice your own diligence and understand what you are investing in.

Once you have defined your goals and constraints, you can work on creating a portfolio designed to suit your needs. The goals and restrictions of mutual fund managers, institutional investors or popular stock collectors are unlikely to match the goals and restrictions of the average investor. If your portfolio goals don’t match your benchmark portfolio goals, their allocation may not suit your needs.