Cryptocurrency

How to Find Cryptocurrency Trading Signals

If you’ve started trading and are thinking of taking it to the next level, we’re here to help. Here are instructions on how to find and use the most profitable crypto trading signals now. Analysis is the study of moving price and security patterns. By examining the stock’s previous price behavior, usually through charts and indicators, traders can predict future information.

Cryptocurrency trading signals can improve trading accuracy and success, which is why the use of crypto signal is so important for any trade, especially in this extremely fast-paced environment. Crypto signals have become very common today with the growth of this lucrative market.

Learning about crypto signals is essential for people who want to invest in the crypto market. Crypto signals are the main selling ideas of how to transact a cryptocurrency asset.

Crypto signals provide entry and exit price points on trading fundamentals and analysis. Expert traders use mathematical calculations and operational data to estimate price movements. These traders charge a reasonable price to provide signals.

How crypto signals works?

Most crypto-trading signal providers operate through Telegram or dissent channels. This is because these platforms make it easy for traders to interact, trade, use crypto trading bots and receive price movement signals. Administrators of individual Telegram channels will post bitcoin signals with all the details of a specific trading opportunity.

Volume

Trading volume is the most basic indicator available. It gives the amount of trading activity in a certain time frame, showed by bars on the chart. Due to its simplicity, the number is usually negligible. Professional traders do not want to know that the number provides much more information than initially meets the eye. The number provides some of the best trading signals for cryptocurrency.

News

News also works as a single in trade industry, such as changes in the macro economy, is an important signal in cryptocurrency trading. In fact, the news and what is happening in the world is important when investing in any other type of asset. The financial industry is celebrating the news. Bad news can cause prices to fall and good news can cause prices to rise dramatically. The big news is the cryptocurrency trading signal, whether it is positive or negative.

Indicators

Mathematical indicators can be applied to the trading chart you are using. They analyze shape data into readable form that traders around the world use to beat the markets and turn a profit. That’s true – indicators can provide trading signals for cryptocurrency. Divergence is one of the most well-known uses of indicators. Divergence is the separation of two lines or paths which helps to analyze market movement.

Support and resistance

In the last Support and resistance is very helpful in technical analysis. Support is price level where buying interest is strong enough to offset selling pressure, allowing for either price stability or upward movement. When the price reaches a support level, purchasers act as “support” to prevent further decline.

The opposite of support is resistance. A resistance level is an area where buying pressure is stronger than selling pressure, which stalls or prevents price advancement.

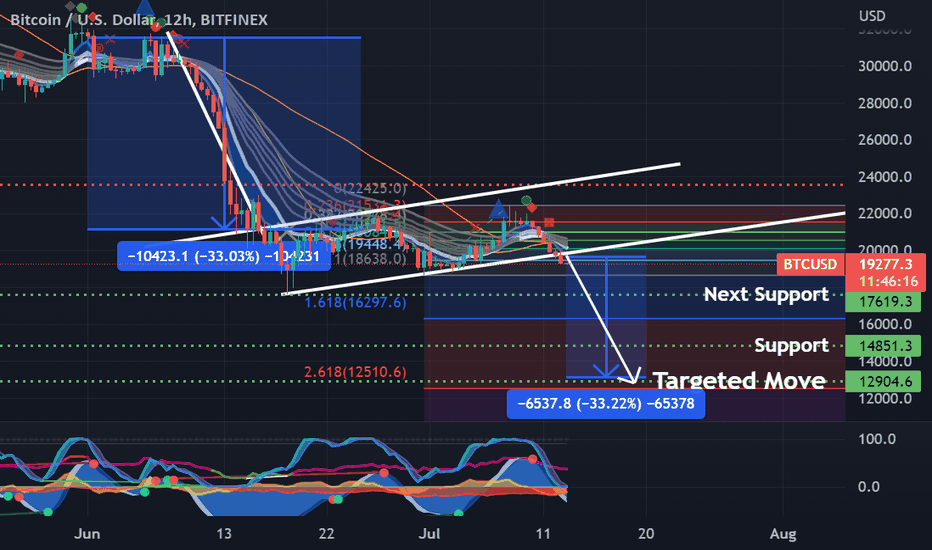

Some traders interpret the breach of a strong support or resistance level as a strong signal to buy or sell cryptocurrencies. See how Bitcoin’s price plunged precipitously after it breached a crucial support level in the image above.

IndexaCo provides EURUSD signals, GBPUSD signals, Financial markets & forex education, analysis and trading forecasts, whether you want forex, stocks, futures, or cryptocurrency trading education, they will explain how to find the best option for you.